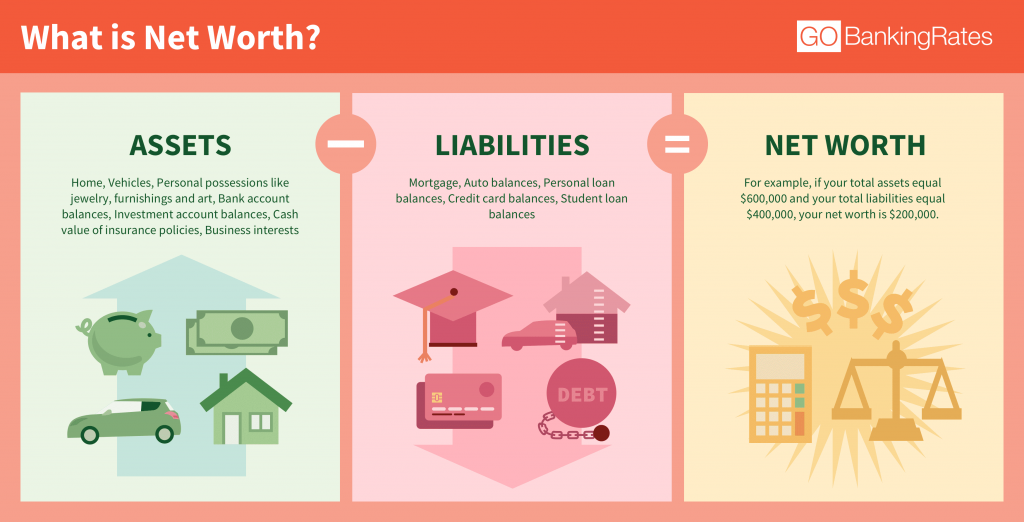

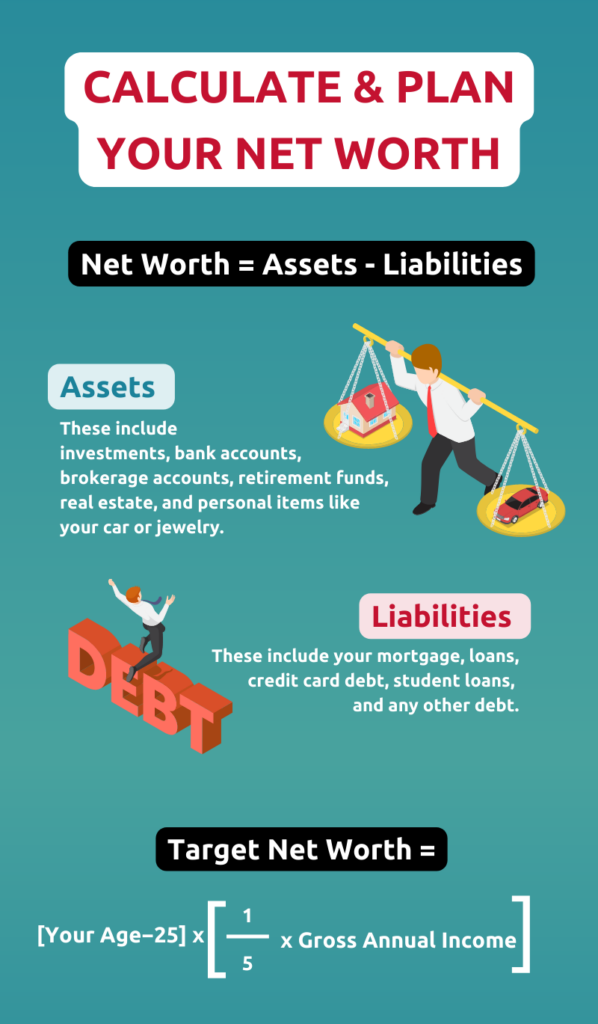

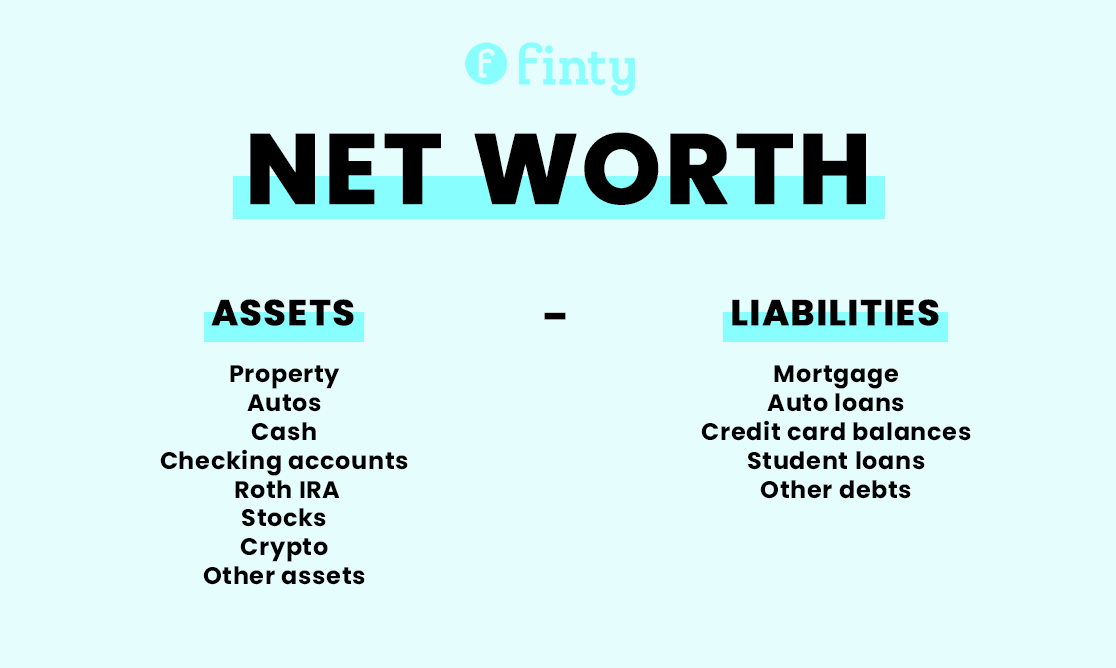

What Is Included In Net Worth Calculation - There are some nuances to the calculation depending. While net worth is an everyday term, i actually recommend you instead calculate your investable net worth as a far more useful and realistic. Calculate your net worth by subtracting your liabilities from your assets. Net worth is the sum of your assets (such as your cash savings, investments, and value of your home) minus the sum of your.

There are some nuances to the calculation depending. Net worth is the sum of your assets (such as your cash savings, investments, and value of your home) minus the sum of your. Calculate your net worth by subtracting your liabilities from your assets. While net worth is an everyday term, i actually recommend you instead calculate your investable net worth as a far more useful and realistic.

Net worth is the sum of your assets (such as your cash savings, investments, and value of your home) minus the sum of your. While net worth is an everyday term, i actually recommend you instead calculate your investable net worth as a far more useful and realistic. Calculate your net worth by subtracting your liabilities from your assets. There are some nuances to the calculation depending.

Liquidity Definition Examples Calculate Liquidity Of

While net worth is an everyday term, i actually recommend you instead calculate your investable net worth as a far more useful and realistic. Net worth is the sum of your assets (such as your cash savings, investments, and value of your home) minus the sum of your. Calculate your net worth by subtracting your liabilities from your assets. There.

How To Calculate Net Worth A Comprehensive Guide IHSANPEDIA

There are some nuances to the calculation depending. Calculate your net worth by subtracting your liabilities from your assets. Net worth is the sum of your assets (such as your cash savings, investments, and value of your home) minus the sum of your. While net worth is an everyday term, i actually recommend you instead calculate your investable net worth.

Net Worth Template Excel

Calculate your net worth by subtracting your liabilities from your assets. Net worth is the sum of your assets (such as your cash savings, investments, and value of your home) minus the sum of your. While net worth is an everyday term, i actually recommend you instead calculate your investable net worth as a far more useful and realistic. There.

Determine Your Net Worth in 3 Easy Steps! New Century Investments

Calculate your net worth by subtracting your liabilities from your assets. Net worth is the sum of your assets (such as your cash savings, investments, and value of your home) minus the sum of your. There are some nuances to the calculation depending. While net worth is an everyday term, i actually recommend you instead calculate your investable net worth.

Creating Your Net Worth Statement — Flat Fee & FeeOnly Financial

Net worth is the sum of your assets (such as your cash savings, investments, and value of your home) minus the sum of your. Calculate your net worth by subtracting your liabilities from your assets. While net worth is an everyday term, i actually recommend you instead calculate your investable net worth as a far more useful and realistic. There.

Know Your Net Worth

Net worth is the sum of your assets (such as your cash savings, investments, and value of your home) minus the sum of your. There are some nuances to the calculation depending. While net worth is an everyday term, i actually recommend you instead calculate your investable net worth as a far more useful and realistic. Calculate your net worth.

How to calculate your net worth Personal Finance Club

There are some nuances to the calculation depending. Net worth is the sum of your assets (such as your cash savings, investments, and value of your home) minus the sum of your. While net worth is an everyday term, i actually recommend you instead calculate your investable net worth as a far more useful and realistic. Calculate your net worth.

Net Worth Calculator, Balance Sheet, Assets and Liabilities Excel

Calculate your net worth by subtracting your liabilities from your assets. While net worth is an everyday term, i actually recommend you instead calculate your investable net worth as a far more useful and realistic. Net worth is the sum of your assets (such as your cash savings, investments, and value of your home) minus the sum of your. There.

What is Net Worth? (And How to Calculate yours)

While net worth is an everyday term, i actually recommend you instead calculate your investable net worth as a far more useful and realistic. There are some nuances to the calculation depending. Calculate your net worth by subtracting your liabilities from your assets. Net worth is the sum of your assets (such as your cash savings, investments, and value of.

How To Calculate Your Net Worth

While net worth is an everyday term, i actually recommend you instead calculate your investable net worth as a far more useful and realistic. Calculate your net worth by subtracting your liabilities from your assets. There are some nuances to the calculation depending. Net worth is the sum of your assets (such as your cash savings, investments, and value of.

Calculate Your Net Worth By Subtracting Your Liabilities From Your Assets.

While net worth is an everyday term, i actually recommend you instead calculate your investable net worth as a far more useful and realistic. There are some nuances to the calculation depending. Net worth is the sum of your assets (such as your cash savings, investments, and value of your home) minus the sum of your.