What Type Of Business Expense Is Software - The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain.

While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain.

Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c.

How Does Expense Management Software Help Your Business?

The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. Software can be a capital expense if it's expected to be used in the business for more than one year and its.

5 Different Types of Accounts in Accounting

The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. Software can be a capital expense if it's expected to be used in the business for more than one year and its.

The Evolution of Expense Management Software A Comprehensive Overview

The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category.

Expense tracking software All you need to know

The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. Software can be a capital expense if it's expected to be used in the business for more than one year and its.

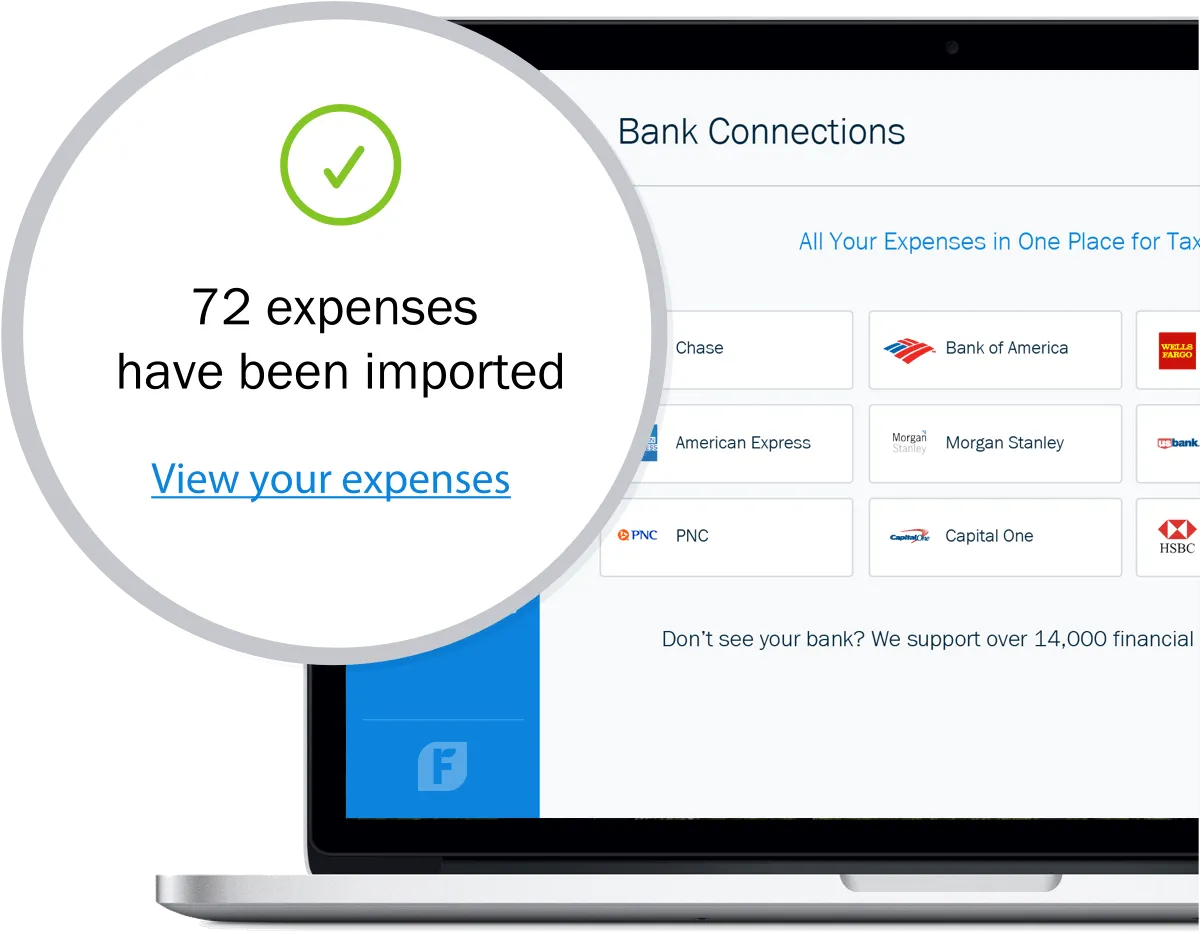

CloudBased Expense Tracking Software Web & Desktop App

Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. The ability to deduct software as a business expense can significantly impact a company’s financial.

How to Choose the Best Expense Software ITILITE

The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category.

20 Business Expense Categories List to Consider for Your Business

The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category.

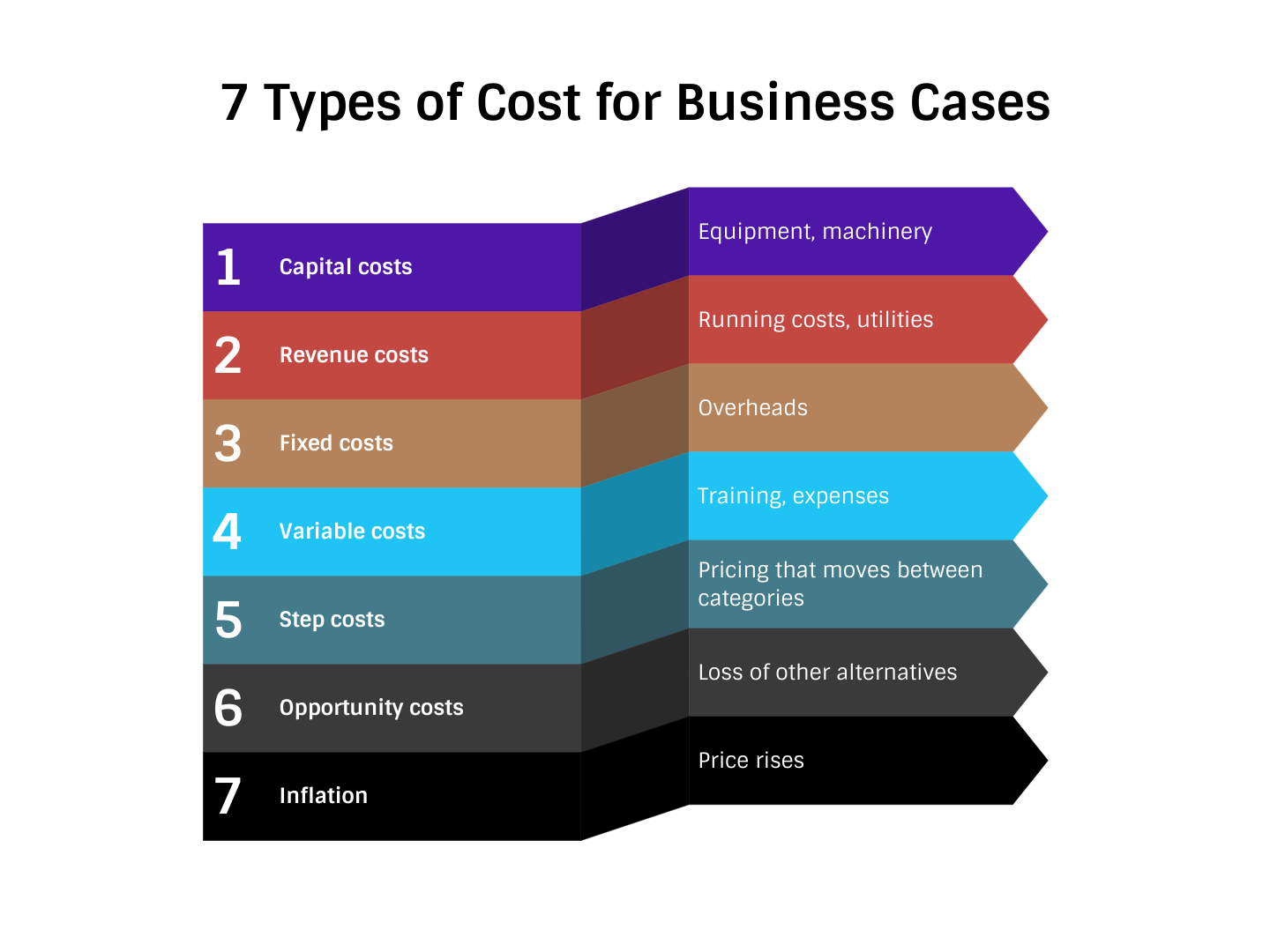

7 Types of cost for your business case

Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category.

Expense tracking software All you need to know

Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. The ability to deduct software as a business expense can significantly impact a company’s financial.

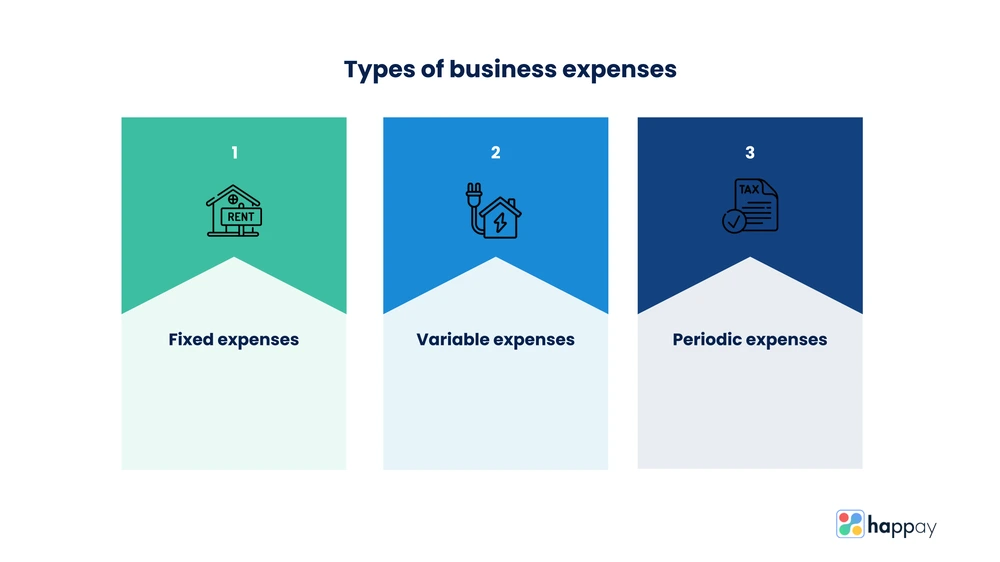

Expense Reports How to Create, Process and Types Happay

While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. The ability to deduct software as a business expense can significantly impact a company’s financial.

Software Can Be A Capital Expense If It's Expected To Be Used In The Business For More Than One Year And Its Cost Exceeds A Certain.

While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability.