Accounting For Stores And Spares - What are best practices for accounting for spare parts and what is the difference between spare parts and capitals. Spare parts are inventories that companies keep on hold for when other fixed items break down or wear out. Accounting expertstalk to an expert The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. By doing so, they can reduce or.

The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Accounting expertstalk to an expert What are best practices for accounting for spare parts and what is the difference between spare parts and capitals. By doing so, they can reduce or. Spare parts are inventories that companies keep on hold for when other fixed items break down or wear out.

What are best practices for accounting for spare parts and what is the difference between spare parts and capitals. Spare parts are inventories that companies keep on hold for when other fixed items break down or wear out. By doing so, they can reduce or. Accounting expertstalk to an expert The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to.

Auto Repair Shop Bookkeeping Template »

Spare parts are inventories that companies keep on hold for when other fixed items break down or wear out. By doing so, they can reduce or. The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Accounting expertstalk to an expert What are best practices for accounting for spare parts.

Miracle POS billing software for automobile and spare parts shop

What are best practices for accounting for spare parts and what is the difference between spare parts and capitals. Accounting expertstalk to an expert The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Spare parts are inventories that companies keep on hold for when other fixed items break down.

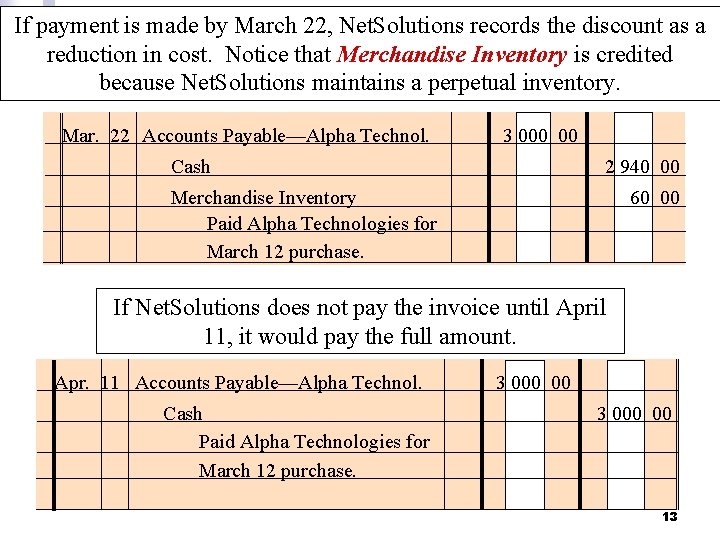

Financial Accounting Lecture ppt download

Accounting expertstalk to an expert The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Spare parts are inventories that companies keep on hold for when other fixed items break down or wear out. By doing so, they can reduce or. What are best practices for accounting for spare parts.

Creating a Parts Inventory Management Spreadsheet (w/ Free Template

Spare parts are inventories that companies keep on hold for when other fixed items break down or wear out. The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. What are best practices for accounting for spare parts and what is the difference between spare parts and capitals. Accounting expertstalk.

6 Accounting for Merchandising Businesses After studying this

What are best practices for accounting for spare parts and what is the difference between spare parts and capitals. By doing so, they can reduce or. Spare parts are inventories that companies keep on hold for when other fixed items break down or wear out. Accounting expertstalk to an expert The accounting treatment of spare parts is a critical aspect.

Retail Store Accounting Methods 101

By doing so, they can reduce or. Spare parts are inventories that companies keep on hold for when other fixed items break down or wear out. Accounting expertstalk to an expert What are best practices for accounting for spare parts and what is the difference between spare parts and capitals. The accounting treatment of spare parts is a critical aspect.

Auto Spare Parts Accounting,Billing and Stock Management GST Ready ERP

By doing so, they can reduce or. What are best practices for accounting for spare parts and what is the difference between spare parts and capitals. Accounting expertstalk to an expert The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Spare parts are inventories that companies keep on hold.

Financial Accounting for Management, Tata McGraw Hill ppt download

The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Spare parts are inventories that companies keep on hold for when other fixed items break down or wear out. What are best practices for accounting for spare parts and what is the difference between spare parts and capitals. By doing.

Spare Parts Inventory Accounting Ifrs Reviewmotors.co

What are best practices for accounting for spare parts and what is the difference between spare parts and capitals. The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. Spare parts are inventories that companies keep on hold for when other fixed items break down or wear out. Accounting expertstalk.

Retail Store Accounting Management Software Nizi Solutions

By doing so, they can reduce or. The accounting treatment of spare parts is a critical aspect of financial reporting that requires careful consideration and adherence to. What are best practices for accounting for spare parts and what is the difference between spare parts and capitals. Spare parts are inventories that companies keep on hold for when other fixed items.

The Accounting Treatment Of Spare Parts Is A Critical Aspect Of Financial Reporting That Requires Careful Consideration And Adherence To.

What are best practices for accounting for spare parts and what is the difference between spare parts and capitals. Accounting expertstalk to an expert By doing so, they can reduce or. Spare parts are inventories that companies keep on hold for when other fixed items break down or wear out.